By Mayra Estrella, Affordable Care Act program

If you or your family did not have health coverage in 2014 and had to pay a penalty (also known as a shared responsibility payment) because you were not covered, you may be eligible for a Special Enrollment Period (SEP) during the end of the tax season, from March 15th through April 30th. This SEP is available if you:

· Are not currently enrolled in coverage through the Marketplace for 2015

· Attest that you filed your 2014 tax return and had to pay a fee for not having health coverage in 2014

· Attest that you first became aware of the fee, or understood how the fee would affect you, after the end of the 2015 Open Enrollment Period (after February 15th, 2015) in connection with preparing your 2014 taxes.

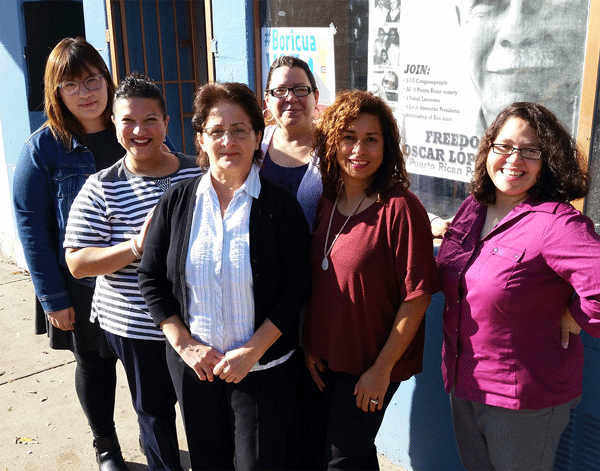

If you enroll in coverage through this tax season SEP before the 15th of the month, coverage will be effective on the first day of the following month. If you enroll in coverage after the 15th of the month, coverage will begin on the first day of the second following month. For free, in-person help from a trained professional (English and Spanish speaker), you can call the Puerto Rican Cultural Center at 773-227-7794 or 773-661-9077.